Great Depression in the United States

UNDER CONSTRUCTION - PLEASE IGNORE!

Depression Data[1] 1929 1931 1933 1937 1938 1940 Real Gross National Product (GNP) 1 101.4 84.3 68.3 103.9 103.7 113.0 Consumer Price Index 2 122.5 108.7 92.4 102.7 99.4 100.2 Index of Industrial Production 2 109 75 69 112 89 126 Money Supply M2 ($ billions) 46.6 42.7 32.2 45.7 49.3 55.2 Exports ($ billions) 5.24 2.42 1.67 3.35 3.18 4.02 Unemployment (% of civilian work force) 3.1 16.1 25.2 13.8 16.5 13.9

1 in 1929 dollars

2 1935-39 = 100

rejoined the gold standard in 1919 and left it and devalued its currency in 1933

On an index of 1928 = 100, wholesale prices fell to 61 in 1933; and industrial production rose to 115 in 1929, fell to 55 in 1932 and did not return to 1928 levels until 1936

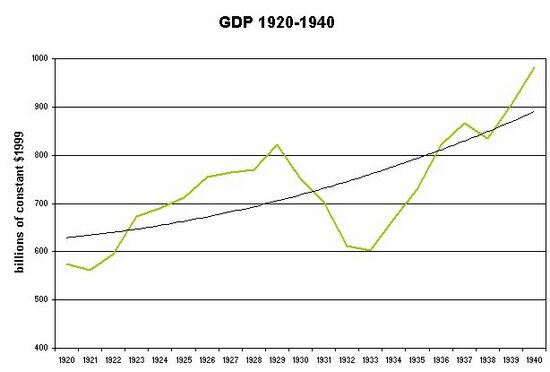

The Great Depression had a significant impact on the economy and people of the United States and began to fully affect the country late in 1930 and early in 1931. The official beginning and ending dates for the economic decline according to the National Beureau of Economic Research were from September of 1929 to March of 1933. At the depth of the downturn, the unemployment rate exceeded 20% and the index of industrial production dropped about 50%. Real or inflation/deflation adjusted gross domestic product ("GDP") grew rapidly after 1933 and surpassed the 1929 high by 1936. There was also a decline or recession from June of 1937 through June of 1938, but real GDP remained above the 1929 high. Employment was much slower to recover. The number of non farm jobs did not surpass the 1929 high until 1939 and the number of total jobs did not surpass the 1929 high until 1941. President Herbert Hoover was widely blamed, and he was defeated in 1932 by Franklin D. Roosevelt. Roosevelt launched a New Deal designed to provide emergency relief to upwards of a third of the population, to recover the economy to normal levels, and to reform failed parts of the economic system. Although F.D.R. reduced unemployment by over 5 million in his first term [1] relatively high unemployment lingered until the early 1940s.

Roosevelt attacked the depression problem on two levels: First, emergency measures, such as social relief programs and make-work programs of all kinds, urgently needed to prevent millions of Americans from literally starving, and give them work—any work. Secondly, on a strategic level, were those measures to reconstruct and develop the country’s totally ruined infrastructure. Dozens of alphabet agencies (AAA, CCC, CWA, FHA [2], FDIC[3], NRA, NRLA, PWA, TVA [4], SEC[5], SSA [6], WPA, etc.) were created as a result of the New Deal. F.D.R. reduced unemployment by over 5 million in his first term—and reconstruct the country by physically changing its economy. [7]

From 1932 onward Roosevelt argued that a restructuring of the economy—a "reform" would be needed to prevent another depression. New Deal programs sought to stimulate demand and provide work and relief for the impoverished through increased government spending, by:

- reforming the financial system, especially the banks and Wall Street. The Securities Act of 1933 comprehensively regulated the securities industry. This was followed by the Securities Exchange Act of 1934 which created the Securities and Exchange Commission. (Though amended, the key provisions of both Acts are still in force as of 2006). Federal insurance of bank deposits was provided by the FDIC (still operating as of 2006), and the Glass-Steagal Act (which remained in effect for 50 years).

- instituting regulations which ended what was called "cut-throat competition" which kept forcing down prices and profits for everyone. (The NRA—which ended in 1935).

- setting minimum prices and wages and competitive conditions in all industries (NRA)

- encouraging unions that would raise wages, to increase the purchasing power of the working class (NRA)

- cutting farm production so as to raise prices and make it possible to earn a living in farming (done by the AAA and successor farm programs)

The most controversial of the New Deal agencies was the National Recovery Administration (NRA) which ordered:

- businesses to work with government to set price codes;

- the NRA board to set labor codes and standards.

These reforms (together with relief and recover measures) are called by historians the First New Deal. It was centered around the use of an alphabet soup of agencies set up in 1933 and 1934, along with the use of previous agencies such as the Reconstruction Finance Corporation, to regulate and stimulate the economy. By 1935, the "Second New Deal" added Social Security, a national relief agency the Works Progress Administration (WPA), and, through the National Labor Relations Board a strong stimulus to the growth of labor unions. Unemployment fell by two-thirds in Roosevelt's first term (from 25% to 9%), but then remained stubbornly high until 1942.

In 1929, federal expenditures constituted only 3% of the GDP. Between 1933 and 1939, federal expenditure tripled, funded primarily by a growth in the national debt. The debt as proportion of GNP rose under Hoover from 20% to 40%. FDR kept it at 40% until the war began, when it soared to 128%. After the Recession of 1937, conservatives were able to form a bipartisan Conservative coalition that stopped further expansion of the New Deal, and, by 1943, had abolished all of the relief programs.

Great Infrastructure Projects

The best of big "hard" infrastructure projects being carried out under the New Deal examples are the results of the Public Works Administration (PWA) [8], a former U.S. government agency established by Congress as the Federal Administration of Public Works, pursuant to the National Industrial Recovery Act, and the almost legendary Tennessee Valley Authority (TVA) [4], both of which, President Roosevelt ran, more or less directly. The PWA became, with its "multiplier-effect" and first two-year budget of $3.3 billion (then an enormous sum), the driving force of America’s biggest construction effort up to that date. By June 1934 the agency had distributed its entire fund to 13,266 federal projects and 2,407 non-federal projects. For every worker on a PWA project, almost two additional workers were employed indirectly. The PWA accomplished the electrification of rural America, the building of canals, tunnels, bridges, highways, streets, sewage systems, and housing areas, as well as hospitals, schools, and universities; every year it used up roughly half of the concrete and one-third of the steel of the entire nation. [9] The development of the huge Tennessee River basin in the South by the TVA was a model for what a modern nation could accomplish. By stopping the yearly floods of the Tennessee River and making it navigable, an entire area of almost the size of England could be opened up for development. Franklin Delano Roosevelt was the first President who attacked this problem from a higher level.

The projects to develop the "hard" infrastructure of the country were flanked by measures to improve its "soft" counterpart: important social measures, which for the first time in U.S. history, established the concept of a minimum wage, created insurance for the unemployed, sick and old, established decent health care, and abolished child labor. The Works Progress Administration (later Work Projects Administration, abbreviated WPA), was created on May 6, 1935 by Presidential order (Congress funded it annually but did not set it up). It was the largest and most comprehensive New Deal agency, employing millions of people and affecting every locality. The crowning achievement of these measures was the Social Security Act of 1935. This law was overturned by the Supreme Court, so that Roosevelt had to pass it in another form the Wagner Act of 1935, the "Bill of Rights" of American labor. Many of the New Deal [10] regulations were abolished or scaled back in 1975-1985 in a bipartisan neoliberal wave of deregulation. However various of them, such as the Federal Housing Administration (FHA) [2], the Social Security Administration (SSA) [6] , the Tennessee Valley Authority (TVA) [4], the Federal Deposit Insurance Corporation (FDIC) [3], the Securities and Exchange Commission (SEC) [5] and the so called Glass-Steagall Act sections of the original Banking Act of June 1933, (sections 16, 20, 21 and 32), which regulates Wall Street, won widespread support and continue to this day.

Series of tax reductions from 1920 to 1931

- The Fed began raising the Fed Funds rate in the spring of 1928, and kept raising it through a recession that began in August 1929. This led to the stock market crash in October 1929.

- When the stock market crashed, investors turned to the currency markets. At that time, dollars were backed by gold held by the U.S. Government. Speculators began selling dollars for gold in September 1931, which caused a run on the dollar.

- The Fed raised interest rates again to try and preserve the value of the dollar. This further restricted the availability of money for businesses, causing more bankruptcies.

- The Fed did not increase the supply of money to combat deflation.

- As investors withdrew all their dollars from banks, the banks failed, causing more panic. The Fed ignored the banks' plight, thus destroying any remaining consumers’ confidence in banks. Most people withdrew their cash and put it under the mattress, which further decreased the money supply.

Between 1929 and 1933, 10,763 of the 24,970 commercial banks in the United States failed. As the public increasingly held more currency and fewer deposits, and as banks built up their excess reserves, the money supply fell 30.9 percent from its 1929 level. Though the Federal Reserve System did increase bank reserves, the increases were far too small to stop the fall in the money supply. As businesses saw their lines of credit and money reserves fall with bank closings, and consumers saw their bank deposit wealth tied up in drawn-out bankruptcy proceedings, spending fell, worsening the collapse in the Great Depression. [11]

The recession of 1937

In 1937, the American economy took an unexpected nosedive that continued through most of 1938. Production declined sharply, as did profits and employment. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. The administration reacted by launching a rhetorical campaign against monopoly power, which was cast as the cause of the new dip. The president appointed an aggressive new direction of the antitrust division of the Justice Department, but this effort lost its effectiveness once World War II, a far more pressing concern, began.

But the administration's other response to the 1937 deepening of the Great Depression had more tangible results. Ignoring the pleas of the Treasury Department, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power. Business-oriented observers explained the recession and recovery in very different terms from the Keynesians. They argued that the New Deal had been very hostile to business expansion in 1935-37, had encouraged massive strikes which had a negative impact on major industries such as automobiles, and had threatened massive anti-trust legal attacks on big corporations. All those threats diminished sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than corporations, and tax policy became more favorable to long-term growth.

On the other hand, according to economist Robert Higgs, when looking only at the supply of consumer goods, significant GDP growth only resumed in 1946 (Higgs does not estimate the value to consumers of collective goods like victory in war) (Higgs 1992). To Keynesians, the war economy showed just how large the fiscal stimulus required to end the downturn of the Depression was, and it led, at the time, to fears that as soon as America demobilized, it would return to Depression conditions and industrial output would fall to its pre-war levels. That is, Keynesians predicted that a new depression would start after the war, unless some government measures were enacted to prevent it, such as the Marshall Plan in destroyed Europe.

References

- ↑ CRAMER, Hartmut. F.D.R.’s 'New Deal': An Example of American System Economics.This speech opened the third panel of the conference, “On the Subject of Startegic Method, in Bad Schwalbach, Germany on May 28, 2000. Footnotes have been added.

- ↑ 2.0 2.1 Federal Housing Administration

- ↑ 3.0 3.1 FDIC - Federal Deposit Insurance Corporation

- ↑ 4.0 4.1 4.2 TVA - Tennessee Valley Authority: From the New Deal to a New Century]

- ↑ 5.0 5.1 SEC - U.S. Securities and Exchange Commission

- ↑ 6.0 6.1 SSA - Social Security History Cite error: Invalid

<ref>tag; name "SSA" defined multiple times with different content - ↑ CRAMER, Hartmut. F.D.R.’s 'New Deal': An Example of American System Economics.This speech opened the third panel of the conference, “On the Subject of Startegic Method, in Bad Schwalbach, Germany on May 28, 2000. Footnotes have been added.

- ↑ PWA - Public Works Administration,The Columbia Encyclopedia, Sixth Edition, 2001-05]

- ↑ McJIMSEY, George. The Presidency of Franklin Delano Rooselvelt, American Presidency Series. University Press of Kanasas, April 2000. ISBN 978-0-7006-1012-9

- ↑ ROSENOF, Theodore. Economics in the Long Run: New Deal Theorists and Their Legacies, 1933-1993. Chapel Hill: University of North Carolina Press, 1997. ISBN 0-8078-2315-5.

- ↑ Gene Smiley: Great Depression, Concise Encyclopedia of Economics